- +376 800 750

- comercial@andorsoft.ad

- Dilluns a Dijous 8:30 a 13:30 - 15:00 a 18:00 | Divendres de 8:00 a 15:00

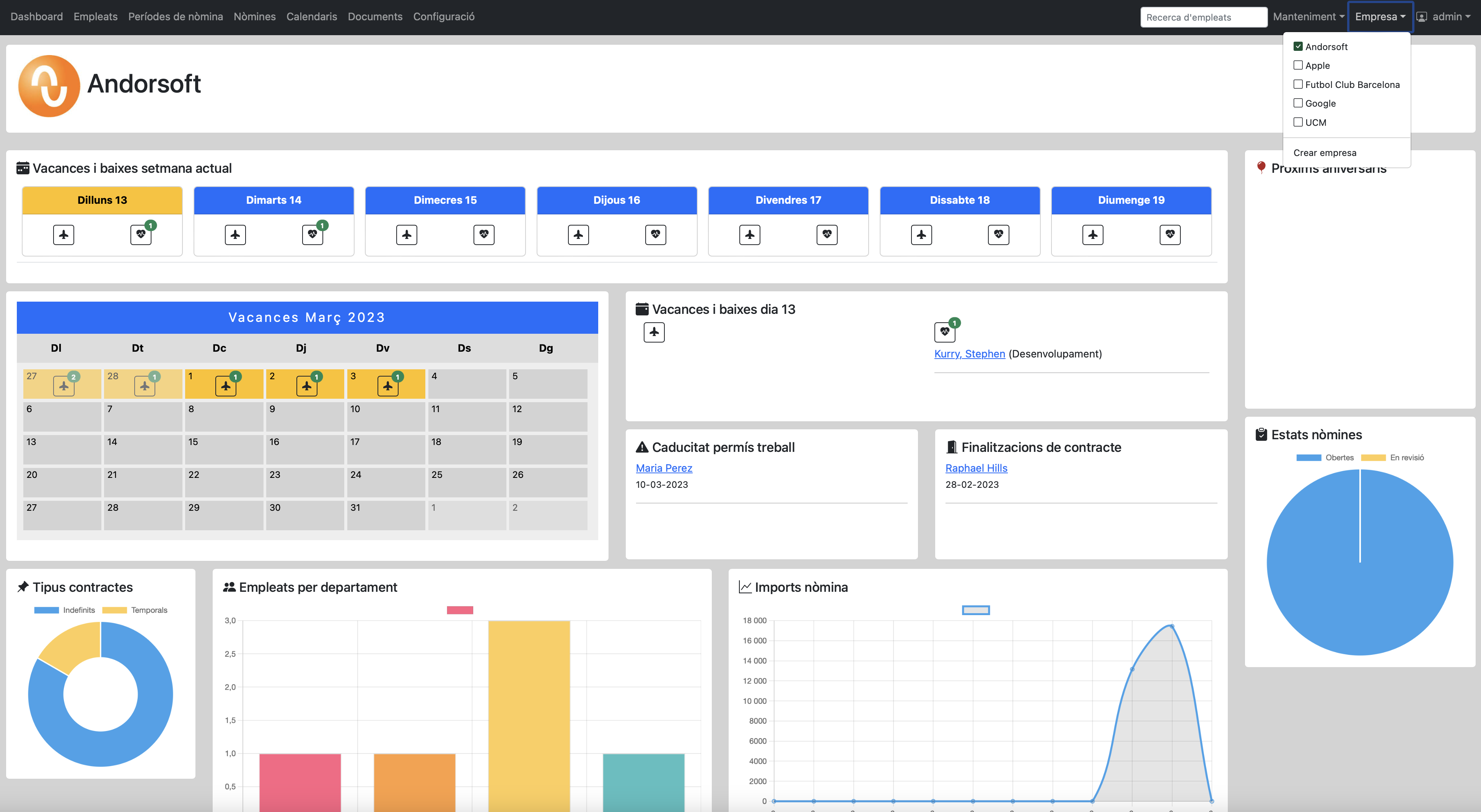

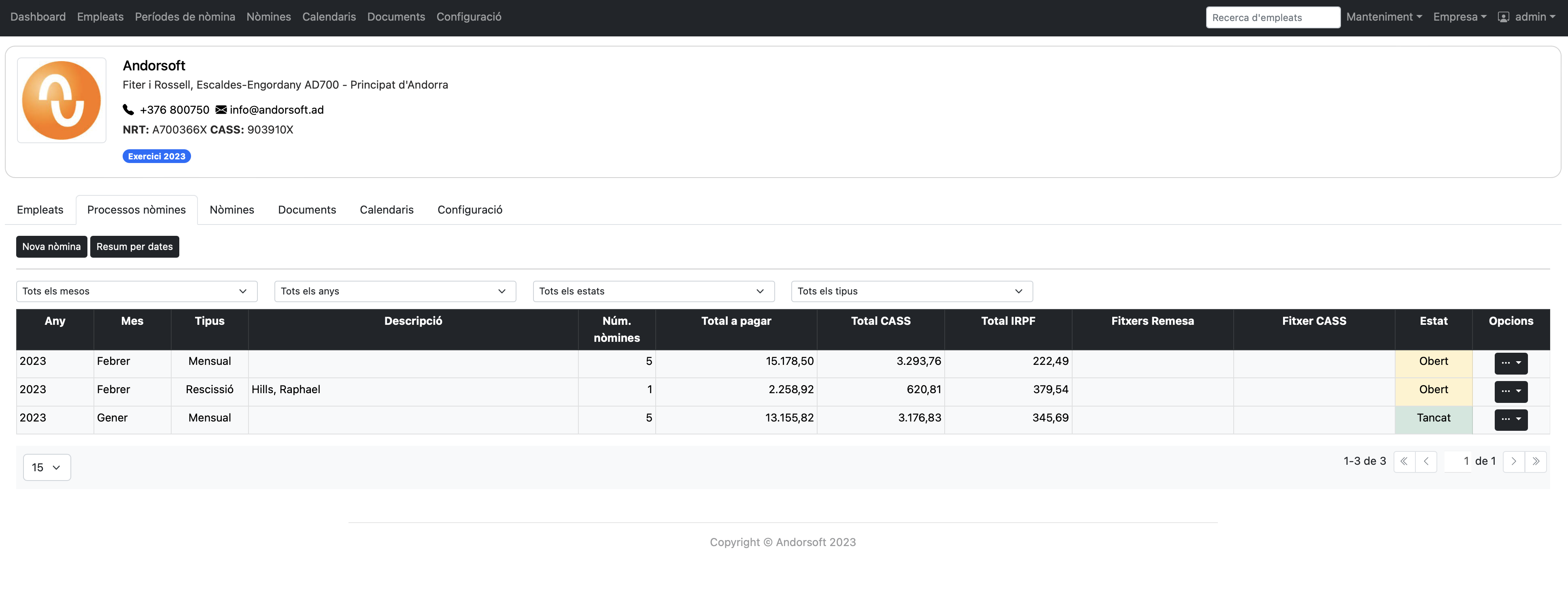

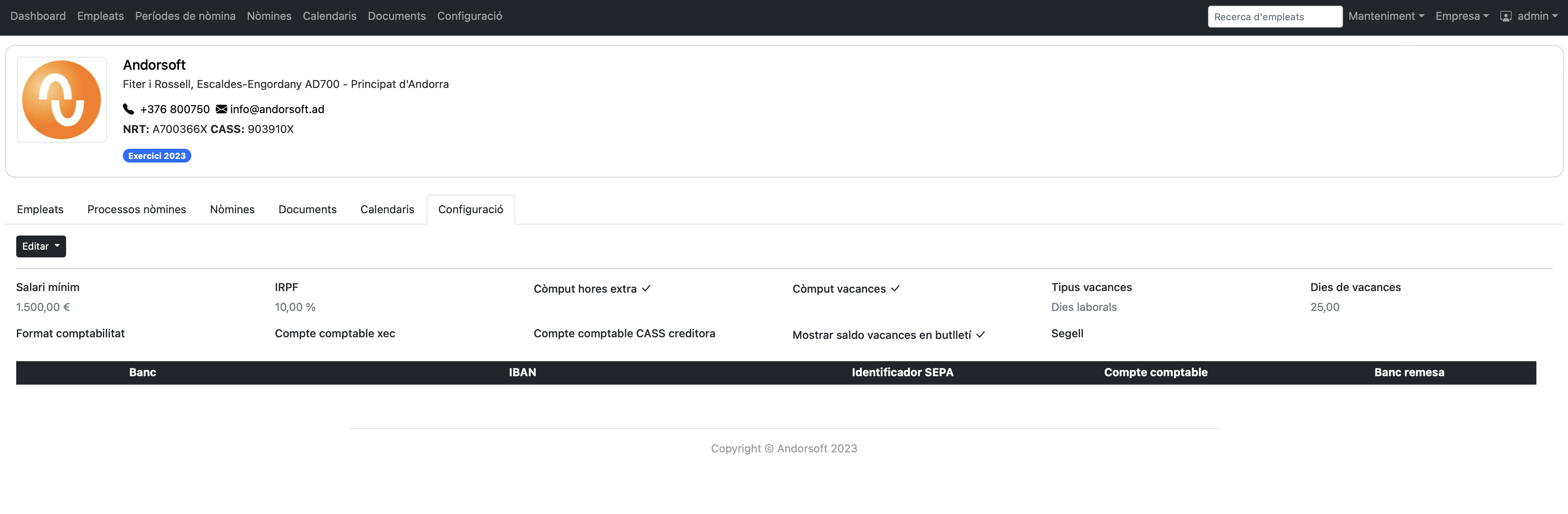

Dashboard amb una interfície minimalista i user friendly

La nostra aplicació ofereix un panell de control intuïtiu i agradable a la vista, que facilita la navegació i l'accés ràpid a totes les funcions importants.